Distribution

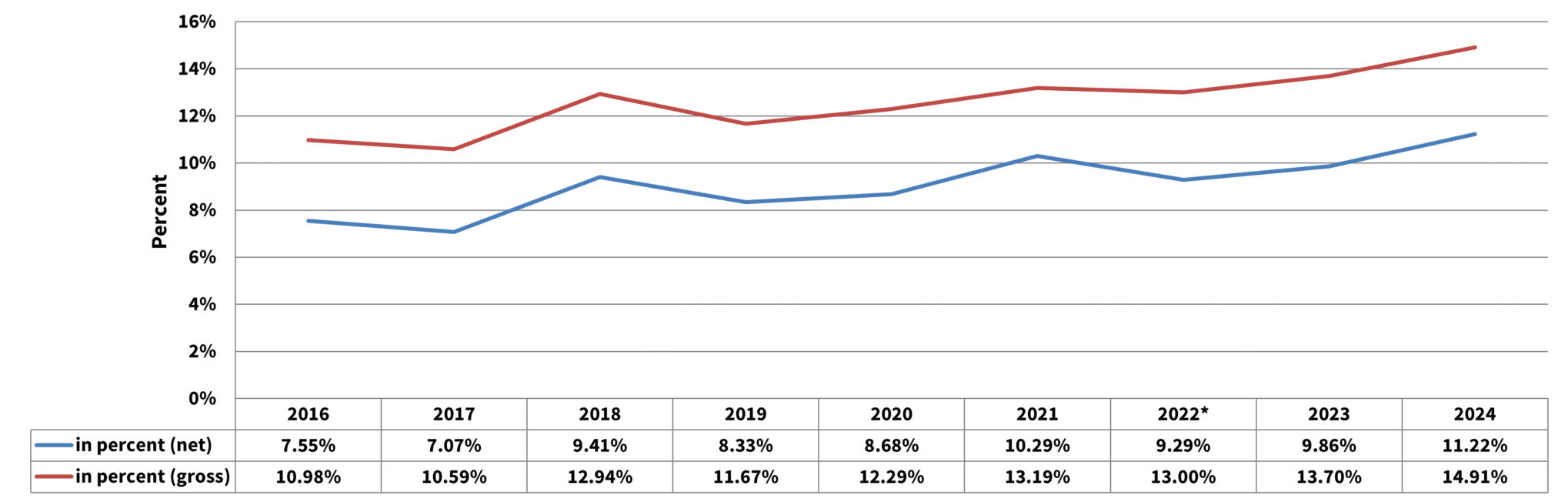

The total income of SWISSPERFORM – after covering the administrative expenses and the 10% deduction for the cultural and social funds/projects – is distributed to the five right holders’ groups. The funds were allocated as follows (2024):

- 19.98% to Audio performers

- 19.90% to Phonogram producers

- 13.23% to Audiovisual performers

- 12.52% to Audiovisual producers

- 34.37% to Broadcasters